It is beneficial for students to open a bank account in the United States for many reasons. With a US student bank account, it is easier to manage finances, keep track of payments, and access financial information. Plus, it provides additional support and financial security for students across the nation.

Opening a US student bank account can offer a variety of advantages for individuals. These include free access to online and mobile banking, direct deposit of student loans or scholarships, and discounts on banking fees. Additionally, US student bank accounts usually offer better interest rates and lower fees than other banking accounts. This allows students to save more money and have more control over their funds.

Financial Services and Organization of a US Student Bank Account

A US student bank account is a great way for students to manage their money while attending school in the United States. It provides access to a variety of financial services, while also ensuring the security of the student’s funds.

Financial services typically offered by student bank accounts include things like checks, debit cards, direct deposits, online banking, and ATM access. Additionally, student accounts also often provide access to special student discounts, such as discounted overdraft fees or discounted interest rates.

Organization of a US student bank account is typically quite simple. Students are generally required to fill out an application at the bank for the account, which will include verifying identity and other information. Once approved, the student will receive a debit card and be able to access the account through the bank’s mobile app or website.

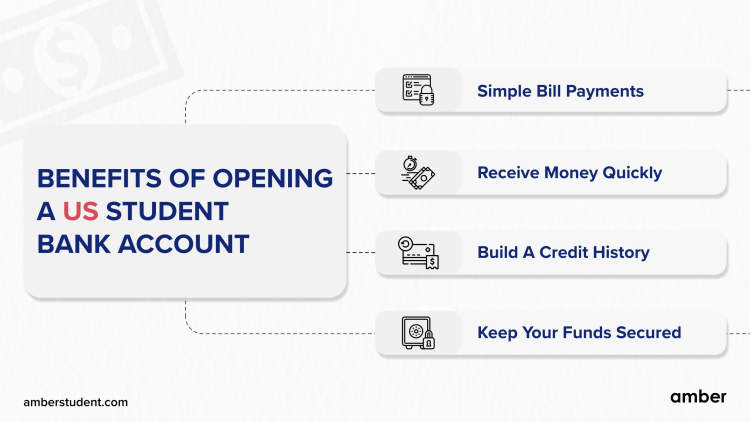

Student bank accounts are a great way for students to manage their finances while studying in the US. Here are some of the benefits of opening a US student bank account:

- Get access to a variety of financial services

- Secure and safe way to store funds

- The ability to access funds quickly and easily

- Access to special student discounts

- Easily manage finances online or through a mobile app

Opening a US student bank account can be the first step toward financial success and independence. Students should consider the benefits of having a student bank account and weigh them against the cost of maintaining the account. For those who decide to open an account, it can provide a valuable resource for managing their finances while studying in the US.

Fees and Other Benefits of Opening a US Student Bank Account

Opening a US student bank account can be an important step towards financial independence for college and university students. There are a number of benefits associated with having a student bank account, including avoiding fees, building a credit history, and gaining access to a variety of account options. Here, we’ll take a look at the fees and other benefits associated with opening a US student bank account.

Fees

Opening a student bank account does not require a lot of funds, as most banks offer no-fee or low-fee accounts for students. Monthly fees and overdraft charges are often waived for student accounts, which can reduce the costs associated with banking. Additionally, many banks offer interest rates that are higher than those offered with regular accounts.

Other Benefits

Beyond reducing fees associated with banking, a US student bank account also provides other benefits. For example, a student bank account can help build a credit history, which is important for future financial decisions and borrowing. Many banks also offer access to valuable financial resources that can help students manage their money. Additionally, most student accounts feature a debit card that can be used to make purchases online and in stores.

Overall, opening a US student bank account can be a great way to save money while taking advantage of the many benefits associated with having an account in the US. With reduced fees, access to financial education resources, and the ability to build a credit history, a student bank account can be an important tool for achieving financial goals.

Understanding Credit History and Benefits of a US Student Bank Account

Having a credit history is important for anyone looking to establish financial stability. A good credit history indicates to potential lenders that you are responsible and financially capable of handling debt. US student bank accounts offer a great opportunity to establish a financial record that can be used to obtain loans, credit cards, and other financial services.

Having a US student bank account also enables you to take advantage of a number of other benefits, such as financial literacy education, convenience, access to ATMs, and secure mobile banking services. Additionally, most student banking accounts come with the ability to track spending, budgeting and saving, and other features that can help you maximize your financial success.

Here are some of the advantages of opening a US student bank account:

- Credit History: Establishing a positive credit history by opening a student bank account is one of the best ways to secure a favorable credit score. This can be beneficial down the line when you need to obtain a loan or apply for a credit card.

- Financial Literacy: US student bank accounts often come with educational programs and resources specifically geared towards teaching financial literacy. This can be an invaluable asset when it comes to understanding banking basics and managing your finances.

- Convenience: a student bank account allows you to easily transfer funds, set up direct deposits, and manage your banking needs without needing to physically visit a bank.

- ATM Access: US student bank accounts usually come with access to a nation-wide network of ATMs, making it easy to withdraw and deposit funds when and where you need to.

- Secure Mobile Banking: With mobile banking, you can manage your student bank account and keep track of your finances on the go. This means you’ll have greater awareness of your spending and access to real-time data.

Opening a US student bank account can give you the financial stability and peace of mind you’re looking for. With a solid credit history, financial literacy, convenience, and secure banking features, it’s clear that there are plenty of benefits to be gained from having a student bank account.

Conclusion

Opening a US student bank account can provide numerous benefits. It can not only serve as an easier banking option for international students, but can also help students manage their finances while living abroad. Moreover, these accounts provide access to additional services such as scholarships, student loan assistance, and credit building opportunities.

Overall, having a US student bank account could help international students to more easily navigate some of the financial challenges of living abroad. With competitive interest rates, convenient services, and personal financial advice, these accounts could prove to be invaluable for international students.