Higher education in the United States can be an expensive affair and it is important to weigh all your financing options carefully. These options include a variety of loans and scholarships for students and their families.

This article will explore the differences between financing your US education with loans versus scholarships and the key advantages and disadvantages of each option. We will also look at the different types of loans and scholarships available to help you make an informed decision.

Overview

Financing a US education can present a daunting task to a potential student. US schools are expensive and often require students to have substantial resources to pay the tuition required by universities. Fortunately, there are multiple financial options available to students. These options include student loans and scholarships.

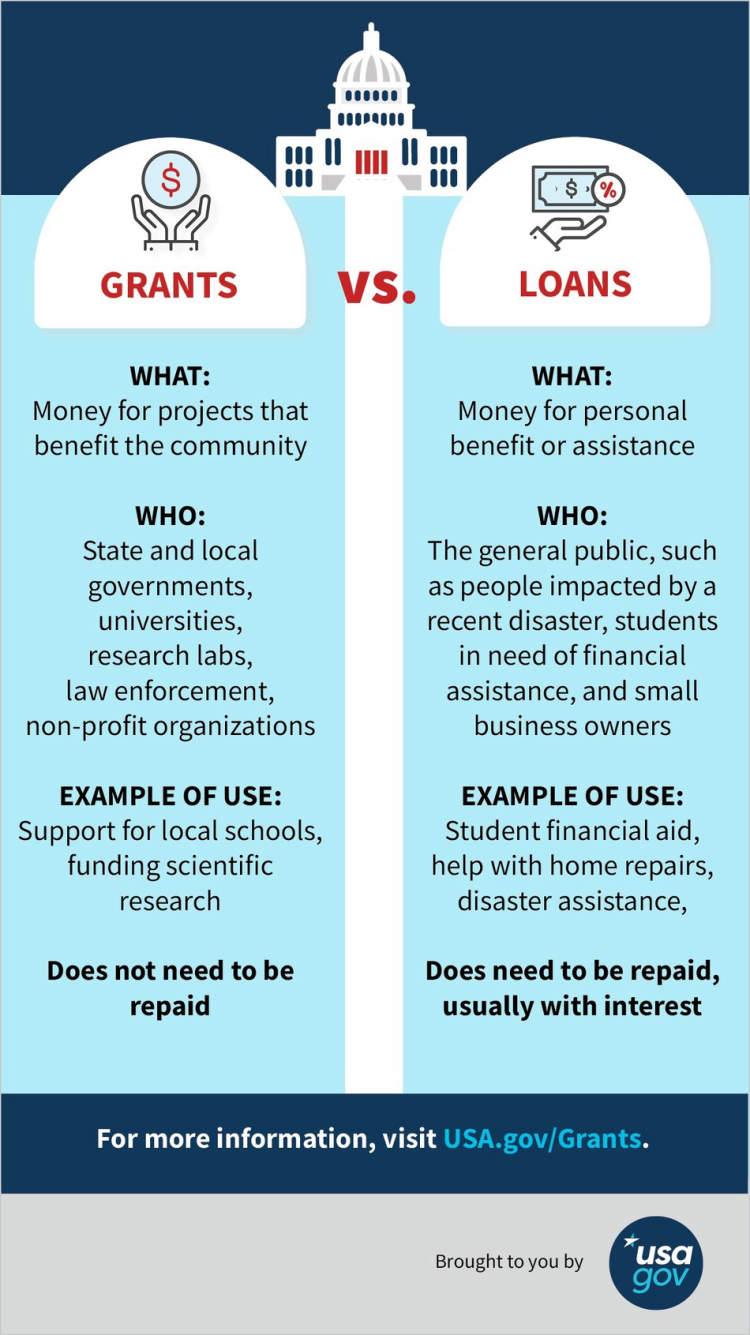

Student loans are a financial option that must be repaid over a set period of time, usually with interest. They can be obtained from the federal government, private lenders, or state government sponsored programs. A student must usually meet a certain level of academic aptitude and economic need to qualify.

Scholarships are a great option for students seeking to pursue a US education, as they are typically awarded to high-achieving students and require little to no repayment. Eligibility for many scholarships is based on the student’s academic success, athletic ability, leadership experience, and other factors. There are numerous awards available to students.

In this article, we will discuss both student loans and scholarships and provide an overview of the benefits, requirements, and considerations for each option.

Types of Loans

When it comes to financing higher education in the US, prospective students have two mainstream options: loans and scholarships. Loans are borrowed sums of money that you have to pay back with interest, while scholarships are sums of money that you don’t have to pay back at all. Below is a brief guide to the different types of loans available to students in the US.

Federal Loans

The US government offers federally backed loans, which are often the most affordable and widely available option for students. Federal loans come in two main types: subsidized and unsubsidized. With subsidized loans, the government covers the interest that accumulates while students are in school, helping to keep down the cost of borrowing.

Private Loans

Another option for students is to take out a loan from a bank or other lending institution. Private loans often require a co-signer and usually have higher interest rates than federal loans. It is generally recommended that students exhaust their federal loan eligibility before turning to private loans.

Parent Loans

Some parents may take out a loan on behalf of their children to help finance college costs. These loans may be either federal parent loans, such as Parent PLUS or private loans. Federal parent loans offer deferred payment options and may come with an interest rate discount if payments are made on time for the life of the loan.

There are several loan products available for students in the US, each with its own benefits and drawbacks. Understanding the differences between loans and scholarships is a key step in financing your education. Understanding the different types of loans can help you determine which financing route best suits your needs.

Types of Scholarships

Scholarships are a great way to finance your education in the US. They are essentially grants for students, and come with a variety of criteria and levels of flexibility. Different types of scholarships have different requirements and award amounts. Here are some of the most popular types of scholarships available:

Merit based Scholarships

Merit based scholarships are generally awarded based on a student’s overall academic performance. These scholarships take into account the student’s grades, test scores, and extracurricular activities. Academic excellence may be rewarded with full tuition scholarships, room and board, and other perks.

Need-Based Scholarships

Need-based scholarships evaluate a student’s financial situation, such as income and family assets. These scholarships are available to students with limited financial resources, and don’t necessarily require high grades or test scores. Need-based scholarships may offer partial tuition assistance, book stipends, and other financial aid.

Private Scholarships

Private scholarships can come from many different organisations and companies. They may offer various awards that can be used at different US universities. Private scholarships tend to offer smaller amounts of financial aid than other types of scholarships, but can still be very helpful.

Athletic Scholarships

Athletic scholarships are awarded to student-athletes who show exceptional ability and competitive drive. These scholarships are offered by universities and may cover the costs of tuition, room and board, as well as academic support. Athletic scholarships generally require a student to maintain a high GPA.

Minority Scholarships

Minority scholarships are awarded to students from underrepresented ethnic backgrounds. These scholarships are offered by US universities and organisations to promote diversity and provide students with greater access to higher education. Minority scholarships can vary in award amounts and may include additional stipends.

Conclusion

Financing your US education can be daunting. The cost of tuition and living expenses can rapidly add up, making it essential to investigate the different options available to you. When it comes to loans and scholarships, both provide a vital financial aid lifeline for students, although they differ in terms of the cost of borrowing and the availability of financial assistance.

Scholarships are an ideal way to bring down high tuition fees and offer non-repaid funding. With loans, interest need to be paid back and loan fees can incur alongside potential credit payments, but for some students, these could be the only viable option. It’s also worth investigating grants for those from lower-income backgrounds.